Did you know… that half of Make Good obligations relate to building services

Did you know… that half of Make Good obligations relate to building services

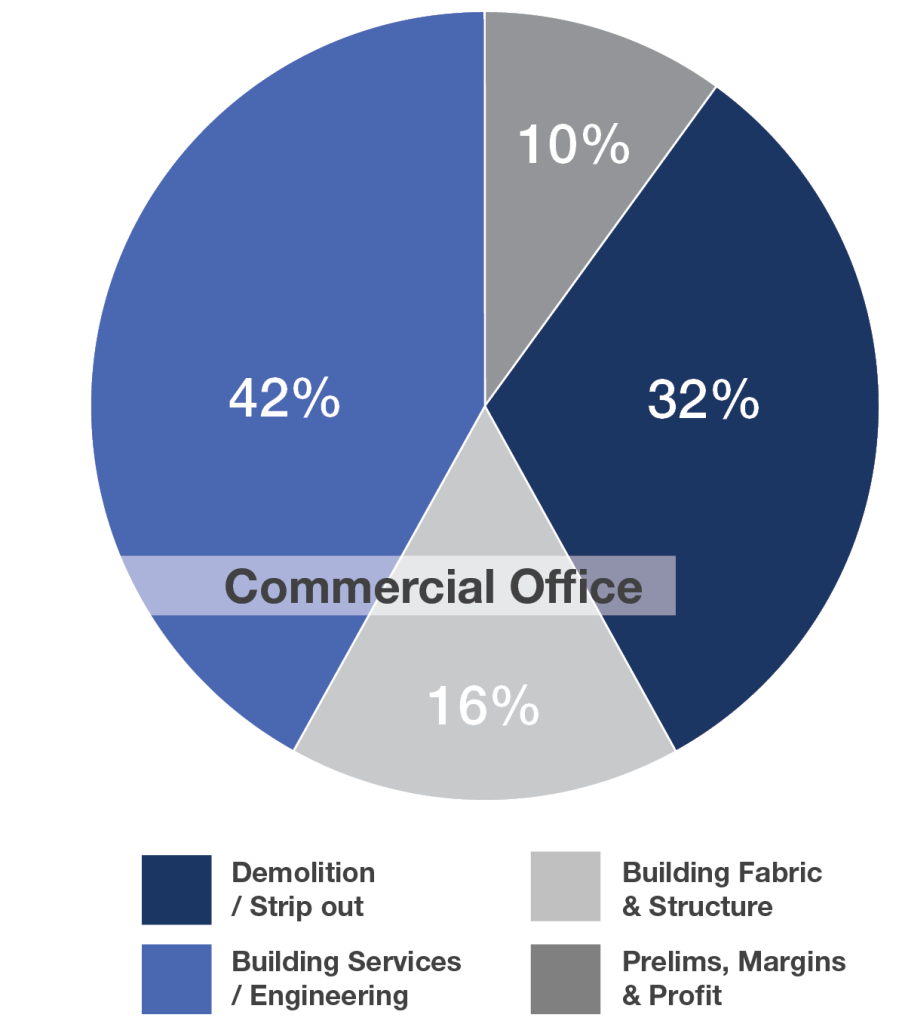

Did you know… through our extensive experience assessing Make Good obligations we have found that almost 50% of the cost of works for commercial offices, relates to building services.

Did you know… through our extensive experience assessing Make Good obligations we have found that almost 50% of the cost of works for commercial offices, relates to building services.

And through our further success in negotiating Make Good settlements we have found that most of the errors we see in Make Good assessments by the opposing party relate to the building services.

Napier & Blakeley directly employ building services engineers as part of our Make Good assessment team to provide accurate and defensible cost estimates. Continue reading

The Lights are off in the Office, because Everybody’s gone Home…

The Lights are off in the Office, because Everybody’s gone Home…

But we’re open for business, and we’re here to help!

But we’re open for business, and we’re here to help!

With the sudden amount of business closures and surrendering of commercial leases, there are many things Landlords need to address and co-ordinate to manage costs, risks, and maximise return.

For example:-

Independent Make Good Assessments

‘Make Good’ obligations are unlikely to be met by Lessees where leases are surrendered or determined due to financial distress, however engagement of independent assessments by Landlords are recommended to provide a basis for Landlord insurance claims and / or claims against receivers and managers of a distressed Tenant. Continue reading