More changes to effective lives

More changes to effective lives

The ATO has released Tax Ruling 2020/3 that took effect on the 1st July 2020.

The ATO has released Tax Ruling 2020/3 that took effect on the 1st July 2020.

New categories of assets have been included:

- Supermarket and grocery stores;

- Aircraft manufacturing and repair services;

- General practice medical services;

- Child care services; and

- Funeral, crematorium and cemetery services. Continue reading

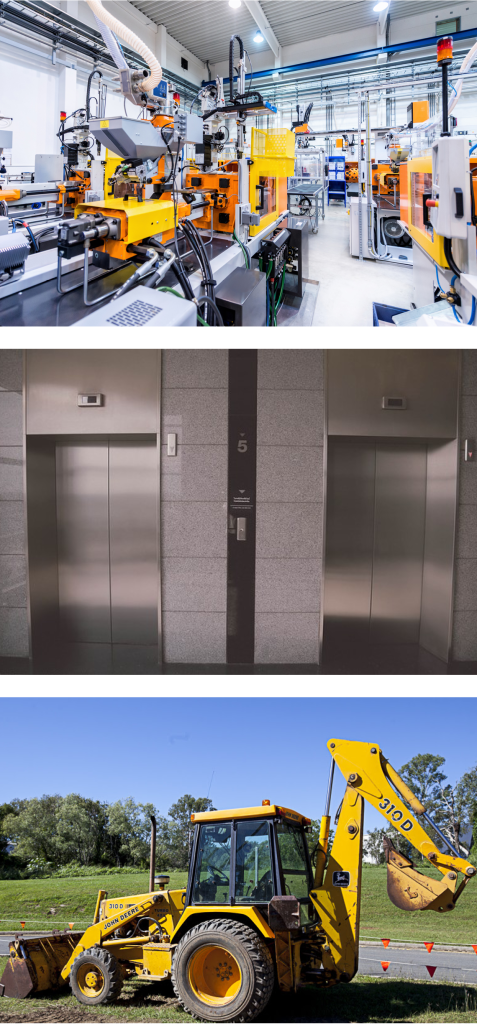

Breaking News – Instant asset write-off for eligible businesses

Breaking News – Instant asset write-off for eligible businesses

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Changes made:

- Instant asset write off eligibility extended to 31 December 2020;

- New and second-hand assets;

- Assets purchased after 7.30 pm (AEDT) on 2 April 2019 but not first used or installed for use until 12 March 2020 to 31 December 2020;

- Instant asset write off eligibility will revert to businesses with an aggregated turnover of less than $10 million and the instant write-off threshold will be $1,000 from 1 January 2021.

What stays the same ?

- Instant asset write-off threshold is still $150,000 (up from $30,000);

- Multiple assets as long as the cost of individual assets is less than the threshold;

- Eligible business threshold increases from $50 million to $500 million;

- Excluded assets including leased for more than 50% of the time on a depreciating asset lease, assets allocated to low value pool, horticultural plants, software allocated to a software development pool and capital works deductions;

- Eligibility test.