Are you a building half-full, or a building half-empty sort of person?

Are you a building half-full, or a building half-empty sort of person?

Either way, Capital Expenditure will still be required and Napier & Blakeley can assist in its quantification, importance, relevance and timing, depending on your plans.

Either way, Capital Expenditure will still be required and Napier & Blakeley can assist in its quantification, importance, relevance and timing, depending on your plans.

Alternatively, and coming from the other direction, we can work with you on developing your capex profiles, which may assist you in making your plans. Together, we then might fine-tune the timing and the scope of the forecast works so it all fits together nicely.

Some Plans that come to mind:

Sale Ready: if you have decided to bring forward the sale of a building, bring us in. We can assess what needs to be done to your buildings in readiness. Napier & Blakeley have a global recognition and acceptance in the provision of Vendor Technical Due Diligence.

Long term hold: with the potential short to medium term impact on valuations, or perhaps extended lease terms, you may decide to hold the property for longer than first planned. Future capex should be assessed to reflect this extended period, so that expenditure is allocated to the right things and at the right time. Continue reading

Have your say on the review of Effective Life of Assets

Have your say on the review of Effective Life of Assets

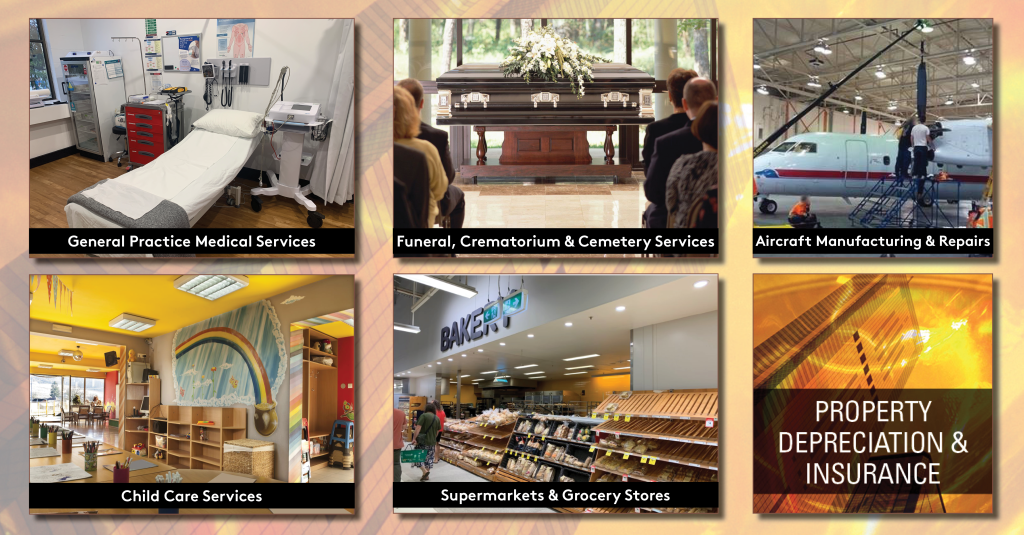

In the latest round of reviews for the Effective Life of Assets, the Australian Taxation Office (ATO) is examining the equipment used in several industries to determine how long these items can be depreciated. Paul Mazoletti, National Director, Commercial Tax division said “the proposed changes could see the life of some items reduced or extended, with possible new items added or others deleted from the list. Consequently, it’s imperative property investors and business operators have a current inventory list and know the effective life of their assets to maximise depreciation.”

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading