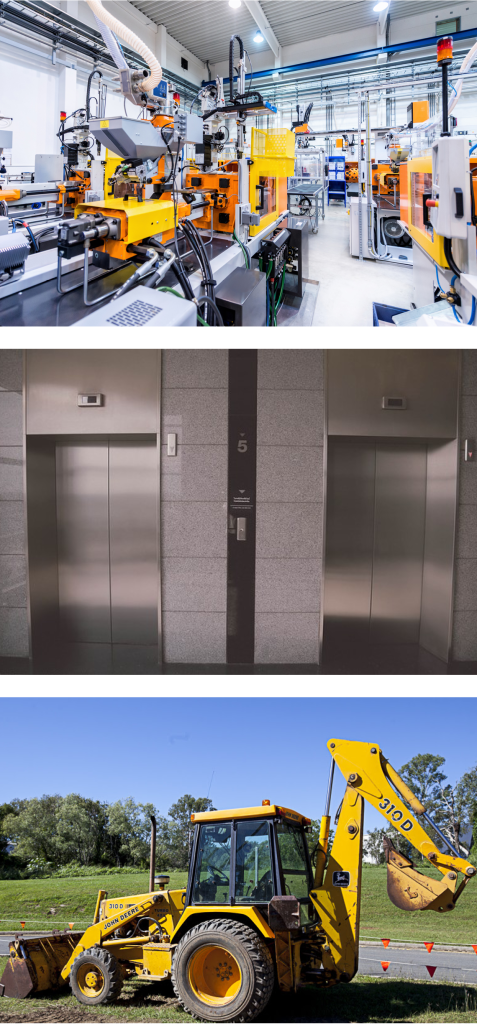

Breaking News – Instant asset write-off for eligible businesses

Breaking News – Instant asset write-off for eligible businesses

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Changes made:

- Instant asset write off eligibility extended to 31 December 2020;

- New and second-hand assets;

- Assets purchased after 7.30 pm (AEDT) on 2 April 2019 but not first used or installed for use until 12 March 2020 to 31 December 2020;

- Instant asset write off eligibility will revert to businesses with an aggregated turnover of less than $10 million and the instant write-off threshold will be $1,000 from 1 January 2021.

What stays the same ?

- Instant asset write-off threshold is still $150,000 (up from $30,000);

- Multiple assets as long as the cost of individual assets is less than the threshold;

- Eligible business threshold increases from $50 million to $500 million;

- Excluded assets including leased for more than 50% of the time on a depreciating asset lease, assets allocated to low value pool, horticultural plants, software allocated to a software development pool and capital works deductions;

- Eligibility test.

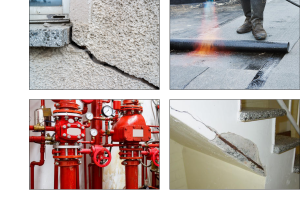

Detect de defects to defeat de defects blues

Detect de defects to defeat de defects blues

Did you know… that inspections during the Defects Liability Period (DLP) are not mandatory?

Did you know… that inspections during the Defects Liability Period (DLP) are not mandatory?

Defects that occur to your assets during DLP can negatively impact performance and the level of compliance.

Defects commonly traverse building structure and cladding, fire protection systems, waterproofing, as well as vital life-safety systems.

Engaging an independent consultant to assess construction defects prior to and during the DLP provides owners with the facts needed to address with their builders before the DLP ends. Continue reading