Have your say on the review of Effective Life of Assets

Have your say on the review of Effective Life of Assets

In the latest round of reviews for the Effective Life of Assets, the Australian Taxation Office (ATO) is examining the equipment used in several industries to determine how long these items can be depreciated. Paul Mazoletti, National Director, Commercial Tax division said “the proposed changes could see the life of some items reduced or extended, with possible new items added or others deleted from the list. Consequently, it’s imperative property investors and business operators have a current inventory list and know the effective life of their assets to maximise depreciation.”

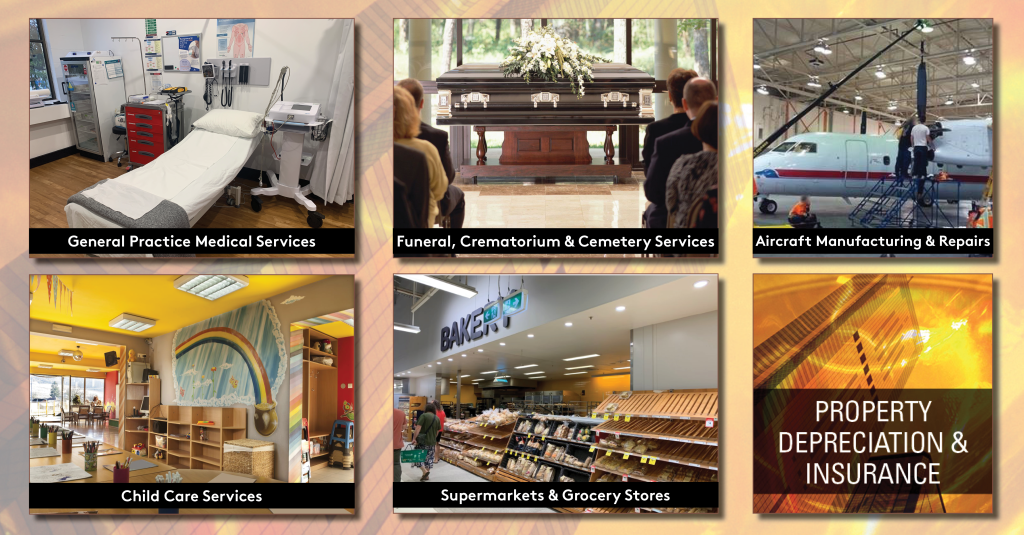

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading

Is your Lodgement day approaching ?

Is your Lodgement day approaching ?

The end of the financial year has come and gone and if your tax lodgement day is approaching we can still assist you to maximise the tax deductions available on your investment property.

The end of the financial year has come and gone and if your tax lodgement day is approaching we can still assist you to maximise the tax deductions available on your investment property.

Not only can we assist you, we guarantee that you get maximum deductions and also be fully compliant with the A.T.O. as we are Registered Tax Practitioners.

Napier & Blakeley, the first Property Depreciation Company and still the best – just ask your Accountant.

Call Napier & Blakeley today for assistance with your Tax Depreciation Schedule or any other Napier & Blakeley services at any of our offices below: Continue reading