Are you maximising your tax deductions?

Are you maximising your tax deductions?

Around four out of five property investors don’t, so you’re not alone.

A professionally prepared Depreciation Schedule will help you reduce taxable income and maximise tax refunds for the life of your property.

- There’s no risk. If we can’t find more than double our fee in deductions for you within the first year, we won’t go ahead.

- Save time and effort. The schedule identifies how much depreciation can be claimed.

- Rest assured. Our in-house accredited tax agents are property tax experts who can enhance the return on your investment. After all, we’ve been doing this longer than any other Australian provider.

Let’s Talk. Contact us on 1300 730 382 now before you lodge your tax return and maximise your property investment returns today.

Kath Hemphill khemphill@napierblakeley.com

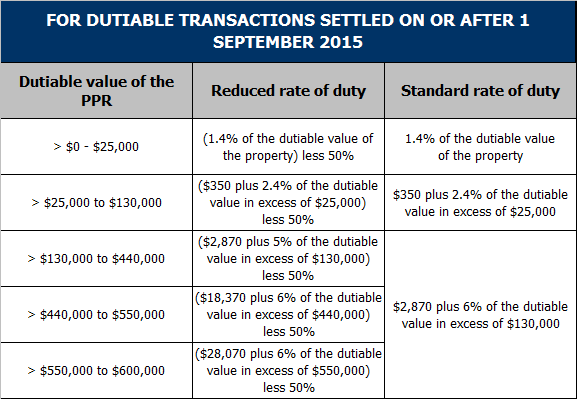

Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September.

The reduction in duty has become increasingly attractive – initially, 20% was reduced on 1 July 2011, followed by 10% on 1 January 2013, 10% on 1 July 2013 and the upcoming 10% on next Monday, 1 September 2014.

It is available for new or established home purchases.

\