Extending The Instant Asset Write-Off

Extending The Instant Asset Write-Off

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

At the time of writing this, it is still unclear what the intent of the changes will mean for property owners and acquired depreciating assets as part of a property transaction. The ATO suggests that eligible businesses will be able to use the instant asset write-off provisions for the business portion of the cost of an assets in the year the asset is first used, or installed ready for use.

What does first use mean?

Date of original commissioned plant?

Does this mean that a “second-hand asset” that is currently in place and has been previously been “put in use” at the time of purchase by an eligible entity will not qualify?

Or is it a question of first use by the acquirer of the asset? Continue reading

Economic Stimulus Packages Aids Asset Write Offs

Economic Stimulus Packages Aids Asset Write Offs

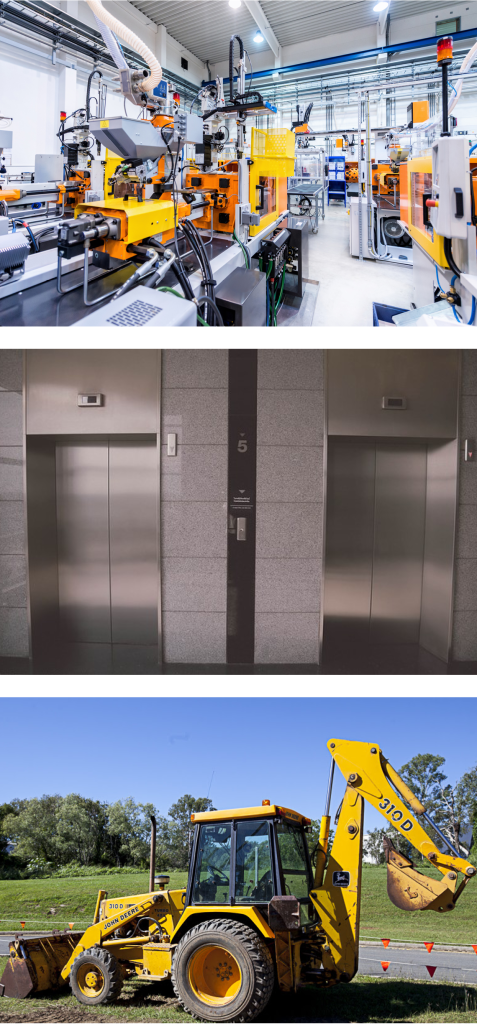

Following the Federal Government’s announcement of a raft of stimulus initiatives, N&B Director John Mathew has summarised how businesses can benefit from an immediate write off of their depreciating assets.

Following the Federal Government’s announcement of a raft of stimulus initiatives, N&B Director John Mathew has summarised how businesses can benefit from an immediate write off of their depreciating assets.

The ruling applies to assets costing $150,000 or less for eligible business, these being a business with an aggregated turnover of less than $500 million effective from 12 March 2020. The interesting part is that the date range for when assets are first used or installed ready for use is 12 March through to 30 June 2020.

Over a career preparing depreciation schedules, John commonly sees tax registers typically capitalising on all work carried out for a year, and then depreciation is calculated from the following year.

The other extreme is that monthly progress payments for multiple separate projects are capitalised and depreciated on a monthly basis although tax law requires a “project to be completed” (ready for use) before a depreciation charge can be taken. Continue reading