Breaking News – Instant asset write-off for eligible businesses

Breaking News – Instant asset write-off for eligible businesses

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Changes made:

- Instant asset write off eligibility extended to 31 December 2020;

- New and second-hand assets;

- Assets purchased after 7.30 pm (AEDT) on 2 April 2019 but not first used or installed for use until 12 March 2020 to 31 December 2020;

- Instant asset write off eligibility will revert to businesses with an aggregated turnover of less than $10 million and the instant write-off threshold will be $1,000 from 1 January 2021.

What stays the same ?

- Instant asset write-off threshold is still $150,000 (up from $30,000);

- Multiple assets as long as the cost of individual assets is less than the threshold;

- Eligible business threshold increases from $50 million to $500 million;

- Excluded assets including leased for more than 50% of the time on a depreciating asset lease, assets allocated to low value pool, horticultural plants, software allocated to a software development pool and capital works deductions;

- Eligibility test.

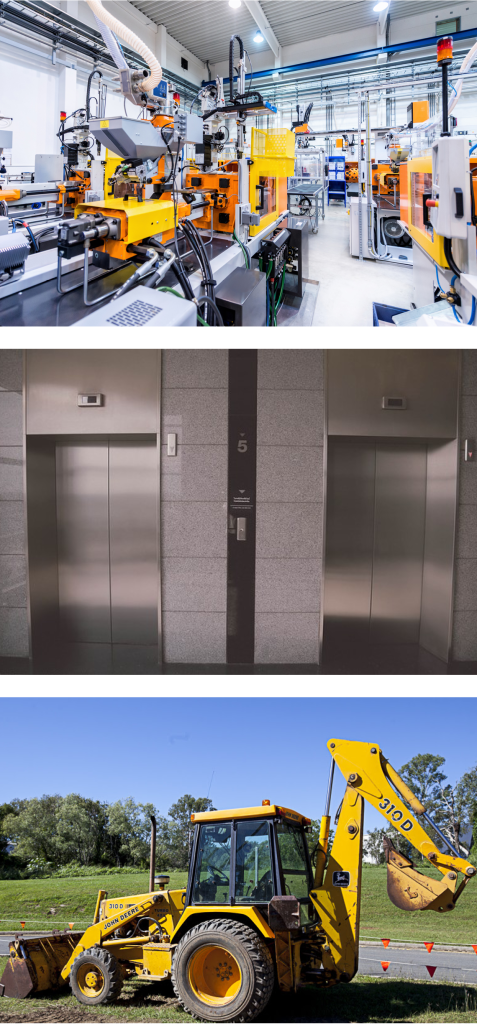

Well, if all things are equal, then a purchase of a property (contract exchanged after 2nd of April 2019 and settled between 12th of March and 31 December 2020) by an eligible business, would see the new owner of the asset be able to claim an immediate deduction for all depreciating assets within the property that is less than $150,000.

The purchase consideration paid for the property will include land, building, depreciating assets and probably non qualifying assets. This is where we are able to assist in establishing the opening value of depreciating assets (on an individual asset basis) and determine if individual assets may qualify for the instant asset write off.

Here is an opportunity to realise some cashflow value for potential new acquisitions.

Please contact one of our registered tax practitioners for any assistance:

|

MELBOURNE John Mathew Director o. 03 9915 6300 m. 0414 559 326 e. jmathew@napierblakeley.com |

|

NATIONAL Paul Mazoletti National Director o. 07 3221 8255 m. 0408 749 202 e. pmazoletti@napierblakeley.com |

|

SYDNEY Peter Osborn Director o. 02 9299 1899 m. 0439 765 571 e. posborn@napierblakeley.com |

|

BRISBANE Kath Hemphill BDM – Tax QLD o. 1300 730 382 m. 0409 722 709 e. khemphill@napierblakeley.com |