Property Tax Allowance Deductions

Property Tax Allowance Deductions

How to maximise the cash from your investment !

Property Ownership

Why is it that when talking about investments, the discussion is based on a net before tax return, and the issue of after tax return is never given proper consideration? In this article using some basic rules of tax depreciation, we will show a simple example of how deductions, when properly calculated, can improve the net after tax cash return of a property investment.

What if this information is not available from the vendor?

Tax ruling 97/25 basically provides the avenue for the owner to have an assessment done by a suitable qualifed professional quantity surveyor such as Napier & Blakeley.

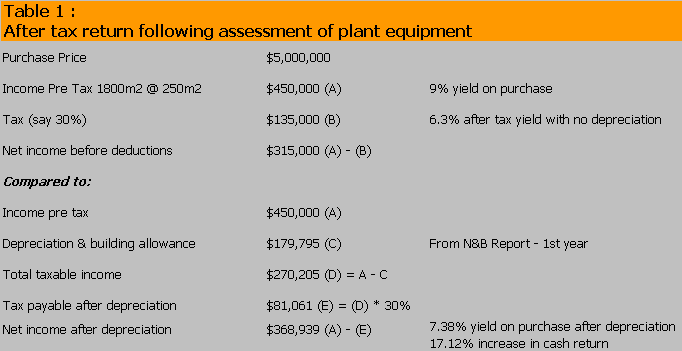

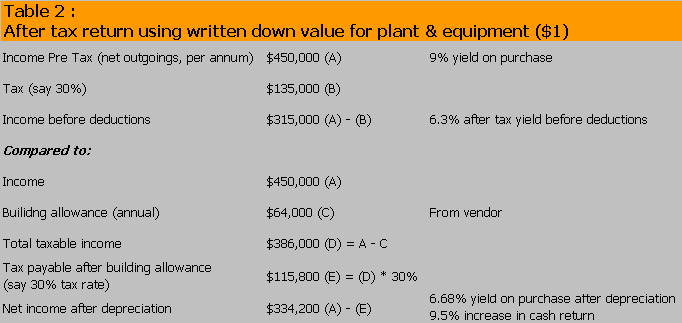

Example – see Table 1

The simple example below shows how a properly prepared property tax allowance assessment can provide icing on the property investor’s cake. We used a $5m office building with 1800m² net lettable space, rented at $250m² to give a total of $450,000 annual income. We also know that it was built in 1995 and includes a land component of $500,000.

- Before buying a property, look at the after tax return prior to making a judgement on value

- Whilst owning a property, consider the effect of demolition, change of use and disposal, and how it would improve after tax return.

- When selling a property, understand the effect of deductions taken on capital gains tax and income tax.

Common Statements made that are incorrect :

“The property is old so there are no depreciation claims left”.

Wrong!

“The vendor was a non tax paying entity (church and the like) who did not claim their allowances, therefore it is available to us as the purchaser.”

Wrong!

“A copy of the vendor’s depreciation schedule was appended to the contract, therefore we have to take the written down values.”

Wrong!

“Depreciation claims are based on the construction cost.”

Not always!

Next time you look at property, it might pay to look into the tax side before making an investment decision. View Property Tax Allowance Deductions Flyer for more information.

Paul Mazoletti p. 07 3221 8255 m. 0408 749 202 e. pmazoletti@napierblakeley.com

Kath Hemphill p. 1300 730 382 m. 0409 227 709 e. khemphill@napierblakeley.com