Tax time, just months away !

Tax time, just months away !

Its March already!

Have you got your depreciation schedules in order?

Getting your tax depreciation or ‘property allowances’ right can make a real difference to reducing your taxable income, slashing your tax bill and putting more cash in your pocket.

Maximising returns

How does it work? You can claim deductions based on two allowances:

1. Depreciation assets:

These are items that lose value more quickly – such as carpet, lifts, and whitegoods. You may be able to claim up to 20% of the property’s purchase price this way.

2. Building allowances:

Depending on when your property was built, you may also be able to claim a deduction for part of the original construction or refurbishment costs.

You may even be able to back-claim previously unclaimed depreciation benefits.

Managing risk

The Australian Tax Office (ATO) requires all assessments of building works to be completed by a suitably qualified professional. That’s us! We’re Quantity Surveyors and we stay at the forefront of ATO requirements, which is worth its weight in gold.

In fact, we were the first Australian company providing specialist property taxation services – and three decades later, we’re still doing it. Plus, we’ve got offices in every major city so we’ve got you covered.

Minimise cost

Here’s some more good news. Our competitive fees are 100% tax deductible. And, if we can’t find more than double our fee in deductions for you within the first year, we won’t go ahead.

With a professionally prepared Property Depreciation Schedule, you can end up with $1000s more in your hand for the life of your property investment. Cash really is king so why spend more than you have to? It’s a great way to unlock cash and grow your property portfolio faster.

Around four out of five property investors have room to move so odds are you do to.

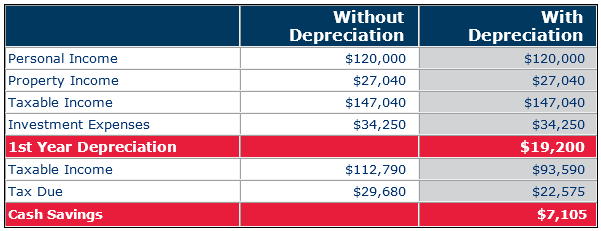

The tables below provide an estimate of the depreciation deductions on a property and how much you might be missing out on.

Estimate based on 37% Tax Bracket. These figures are of a general nature and should not be applied or acted upon unless supported by our specialised advice. The above rates do not include the Medicare Levy. They must not be used for taxation purposes in this form. Division 43 Allowances are calculated on the PRIME COST METHOD. A claim will be dependent on the purchaser’s tax position.

Make your move today.

Contact us on 1300 730 382 and let N&B support you to the max.

Kath Hemphill

National Residential Manager

M: 0409 722 709

E: khemphill@napierblakeley.com