Building Developers and Owners are Being Sandwiched

Building Developers and Owners are Being Sandwiched

Costs, Risks and Returns are being impacted by uncertainty around the future acceptability of Aluminium Composite Cladding Panels (ACP).

Costs, Risks and Returns are being impacted by uncertainty around the future acceptability of Aluminium Composite Cladding Panels (ACP).

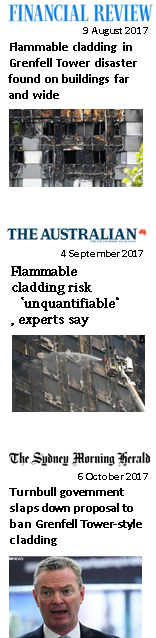

Since the Lacrosse Apartment building fire in 2014 and the tragic Grenfell Tower fire of 2017, there are still more questions relating to the use of flammable ACP than answers.

Industry, governing bodies, financiers, building owners and occupiers, are yet to really understand their options.

- Will the import and use of flammable ACP in Australia be banned? – one of the suggestions made by the Senate’s interim enquiry report.

- Will the National Construction Code and Building Regulations be revised to require increased fire safety around the use of ACP? – as suggested by the current draft amendment out for public comment.

- Will the ‘grey area’ of whether the ACP is an attachment or part of an external wall be confirmed?

- Will Government required audits lead to large scale removal of flammable ACP and replacement with compliant materials?

- Will insurers carve out flammable ACP from insurance policies? Will premiums increase?

- Is the reputation of ACP tarnished so much so that developers and architects turn their back on the material – as recently reported by Uniting Communities with their U City development in Adelaide? Continue reading

Tax time is here – Are you paying too much tax ?

Tax time is here – Are you paying too much tax ?

Do you own or have you bought an investment property in the past financial year?

Do you own or have you bought an investment property in the past financial year?

Or… have you recently refurbished, altered or extended your investment property in the past financial year?

Or… do you own an investment property but have never claimed depreciation in the past?

Or… own any property including commercial, retail, industrial, residential, pubs, clubs, sporting – we are experts in them all.

If your answer is yes to any of these questions then you may very well be paying too much tax on your income if you don’t claim your depreciation deductions. Continue reading