It’s your money… don’t let it get away !

It’s your money… don’t let it get away !

Are you getting the best return from your investment property ?

Are you getting the best return from your investment property ?

Each year, millions of dollars in property depreciation goes unclaimed by property investors who don’t know how and what to claim – or who find the whole thing too hard.

Let us worry about it, so you don’t have to.

Napier and Blakeley are the property tax depreciation specialists. We’ve been working for investors for over thirty years, making sure they maximise their deductions – and get the best return. Our specialist quantity surveyors are among the most experienced and qualified in the country, and are advised by our research team on the latest revisions from the Australian Taxation Office. Continue reading

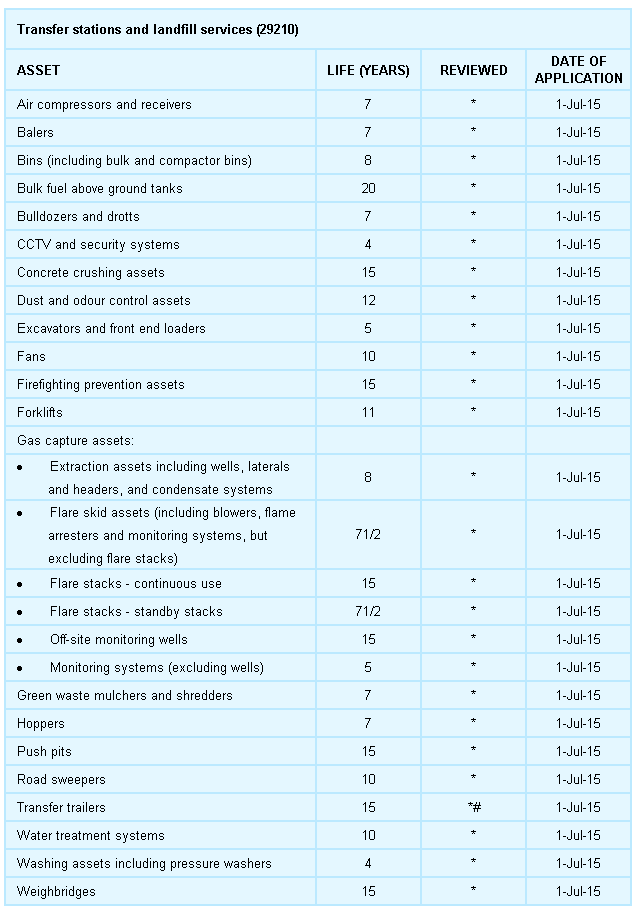

Capital Allowances: Draft Effective Lives of Assets used in Transfer Stations and Landfill Services

Capital Allowances: Draft Effective Lives of Assets used in Transfer Stations and Landfill Services

The following is a recent release from the ATO and their understanding of new Effective Lives which can now be used for depreciation purposes, effective from July 2015 for the Transfer Station and Landfill industry sectors.

They are seeking comments on a draft list of Effective Lives they are releasing for assets used in Transfer Stations and Landfill services.

Proposed new determinations

They are proposing to add the following list of Effective Life determinations to the Commissioner’s schedule to apply to new assets either purchased and first used, or installed ready to use, on or after 1 July 2015 (within the meaning of section 40-95 of the Income Tax Assessment Act 1997). The effective life listed below for each asset basically determines the depreciation rate e.g.: 20 life years = a basic rate of 5% per annum can be claimed on the cost of the item to the income producing taxpayer.