Extending The Instant Asset Write-Off

Extending The Instant Asset Write-Off

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

At the time of writing this, it is still unclear what the intent of the changes will mean for property owners and acquired depreciating assets as part of a property transaction. The ATO suggests that eligible businesses will be able to use the instant asset write-off provisions for the business portion of the cost of an assets in the year the asset is first used, or installed ready for use.

What does first use mean?

Date of original commissioned plant?

Does this mean that a “second-hand asset” that is currently in place and has been previously been “put in use” at the time of purchase by an eligible entity will not qualify?

Or is it a question of first use by the acquirer of the asset?

Example:

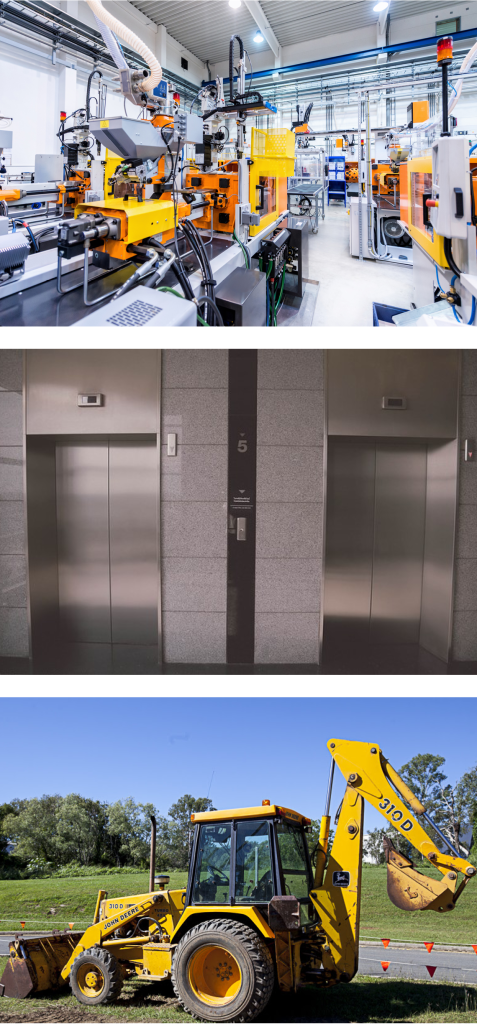

Joe Blogs Pty Ltd acquires an office building for investment (capital growth and income) The entity is deemed to be carrying on a business in accordance with TR2019/1 (another conversation for another day) and is eligible to claim the instant write off.

- The office building is 5 years old.

- Settlement occurs on the 20th of July 2020.

Is the 20th of July the first use date by Joe Blogs Pty Ltd and therefore the depreciating assets would qualify for the instant write off provisions?

It would make sense that it would, as if Joe Blogs Construction Pty Ltd (JBC) purchased a $130,000, 5 year old backhoe for their construction business and the first use date was the 20th of July 2020, then the second-hand asset would qualify as being put to use on that date.

If this is the intent of the government, it is indeed good news for the economy.

We at N&B are here to help. Please do not hesitate to contact one of our trusted advisors for further assistance:

|

MELBOURNE John Mathew Director o. 03 9915 6300 m. 0414 559 326 e. jmathew@napierblakeley.com |

|

NATIONAL Paul Mazoletti National Director o. 07 3221 8255 m. 0408 749 202 e. pmazoletti@napierblakeley.com |

|

SYDNEY Peter Osborn Director o. 02 9299 1899 m. 0439 765 571 e. posborn@napierblakeley.com |

|

BRISBANE Kath Hemphill BDM – Tax QLD o. 1300 730 382 m. 0409 722 709 e. khemphill@napierblakeley.com |