Is your existing Depreciation Schedule just a Placebo ?

Is your existing Depreciation Schedule just a Placebo ?

There have been a few movements in the area of depreciation over the 2010/11 financial year overall, though there are not that many changes over the past 12 months that you should be concerned about… or is there?

There have been a few movements in the area of depreciation over the 2010/11 financial year overall, though there are not that many changes over the past 12 months that you should be concerned about… or is there?

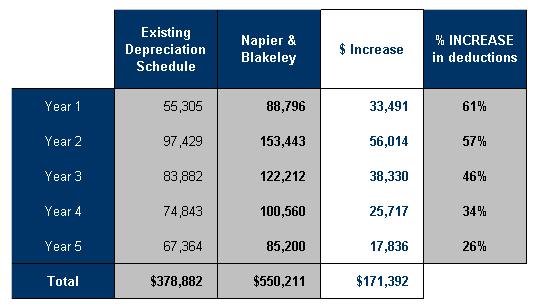

Below is an example of a depreciation schedule, a client asked Napier & Blakeley to provide a health check on, with regard to the dollar value of their depreciation claims.

This property relates to a strata property purchased in a capital city CBD area, the building was a number of years old.

The numbers below are the actual figures.

Over a 5 year period, Napier & Blakeley increased this client’s depreciation claim by 45% or in cash terms based on a 30% company tax rate - the client received an additional $51,000 cash over a 5 year period.

So is there something about this year’s depreciation claim that you should be concerned about?

Needless to say the client was very happy with the result, but there were a few grey edges to this silver lining.

Don’t forget that essentially, depreciation cannot be claimed retrospectively if you have already submitted tax returns for a tax period.

The only way of claiming any missing allowances is by re-opening past accounts. The re-opening of accounts is an exercise that very few people are willing to do, so what can you do and what else should you be looking out for.

- Start off on the right foot; engage a specialist Quantity Surveyor with a proven track record for all acquisitions, construction projects and refurbishments.

- Get a health check done on your existing depreciation schedules.

- Claim the write off for demolished assets.

- If keeping track of assets is important to you, get an asset register that relates to your depreciation schedules.

- Claim for landlord owned fit outs.

- Get your depreciation schedules updated annually by the Quantity Surveyor.

Most accountants recognise that using a Quantity Surveyor saves you time and money and puts you in the driving seat when it comes to good asset management; ask yours how they are making the most of the opportunities available to you.

Napier & Blakeley is the most relied upon Quantity Surveying firm in the matter of maximising the benefits that Tax Depreciation can provide to the bottom line make them part of your good asset management.

Contact

If you want further information on tax depreciation, or any other Napier & Blakeley services please contact any of our offices below:

Melbourne - John Mathew 03 9915 6300 jmathew@napierblakeley.com

Napier & Blakeley services

- Technical Due Diligence

- Capital Expenditure Planning

- Quantity Surveying

- Strategic Asset Management

- Building & Sustainability Consulting

- Property Depreciation

Comments are closed.

Categories

- Careers at Napier & Blakeley (13)

- Commentary (70)

- Financiers Reports (1)

- Insurance (6)

- Maintenance (4)

- Make Good (10)

- Project Advisory (1)

- Property Tax (74)

- Quantity Surveying (28)

- Regulatory Compliance (2)

- Sustainability (36)

- Technical Due Diligence (30)

- Uncategorized (8)