Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September.

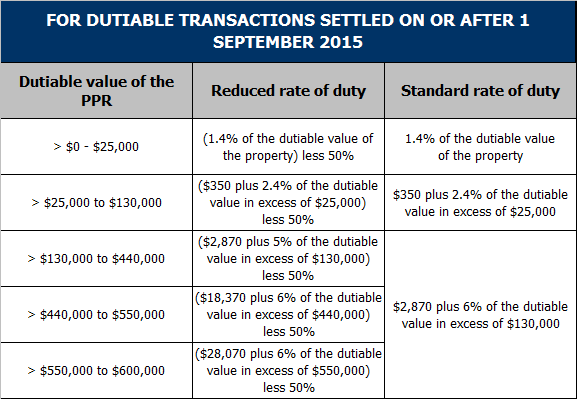

The reduction in duty has become increasingly attractive – initially, 20% was reduced on 1 July 2011, followed by 10% on 1 January 2013, 10% on 1 July 2013 and the upcoming 10% on next Monday, 1 September 2014.

It is available for new or established home purchases.

\

It’s Tax Time – Are you paying too much tax?

It’s Tax Time – Are you paying too much tax?

Have you bought an investment property in the past financial year?

Have you bought an investment property in the past financial year?

Have you recently refurbished, altered or extended your investment property in the past financial year?

Do you own an investment property but have not claimed depreciation in the past?

If your answer is yes to any of these questions then you may very well be paying too much tax.

Depreciation schedules are a vital part of any property investment, they assist in reducing taxable income and maximising your tax refund.

Property tax allowances (commonly known as depreciation) provide an opportunity for owners of income producing property to reduce their taxable income, thus reducing the tax payable. Napier & Blakeley was the first Australian company to provide specialist property depreciation services with dedicated in-house specialists to identify all available deductions throughout the life cycle of your asset. Continue reading