Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September

Victorian first time home buyers will pay less stamp duty for homes from 1 September.

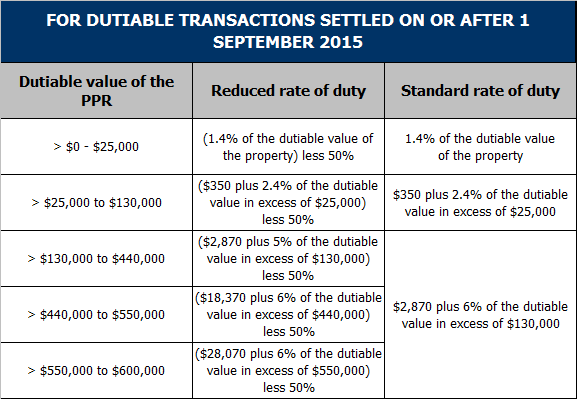

The reduction in duty has become increasingly attractive – initially, 20% was reduced on 1 July 2011, followed by 10% on 1 January 2013, 10% on 1 July 2013 and the upcoming 10% on next Monday, 1 September 2014.

It is available for new or established home purchases.

\

Property Depreciation and Natural Disasters

Property Depreciation and Natural Disasters

Over the last 6 months, with the unfortunate spate of different Natural Disasters occurring Napier & Blakeley have been requested from numerous clients what effect does it have on their existing and future capital allowances for their investment properties.

The question arises where funds from a third party such as an insurer pays for capital works.

No Insurance

Where there is no insurance claim, then all demolished capital items may be written off from the date of demolition. All newly installed and refurbished costs may be claimed once works have been completed.

Tip – ensure you keep all records of expenditure including all associated on costs such as skip hire, professional fees and the like.