Breaking News – Instant asset write-off for eligible businesses

Breaking News – Instant asset write-off for eligible businesses

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Looks like it’s official. The ATO has issued an update on the instant write-off eligibility.

Changes made:

- Instant asset write off eligibility extended to 31 December 2020;

- New and second-hand assets;

- Assets purchased after 7.30 pm (AEDT) on 2 April 2019 but not first used or installed for use until 12 March 2020 to 31 December 2020;

- Instant asset write off eligibility will revert to businesses with an aggregated turnover of less than $10 million and the instant write-off threshold will be $1,000 from 1 January 2021.

What stays the same ?

- Instant asset write-off threshold is still $150,000 (up from $30,000);

- Multiple assets as long as the cost of individual assets is less than the threshold;

- Eligible business threshold increases from $50 million to $500 million;

- Excluded assets including leased for more than 50% of the time on a depreciating asset lease, assets allocated to low value pool, horticultural plants, software allocated to a software development pool and capital works deductions;

- Eligibility test.

Extending The Instant Asset Write-Off

Extending The Instant Asset Write-Off

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

On the 9th of June 2020, the government announced that it will extend the $150,000 instant asset write off until 31 December 2020. This proposed change is not law yet as of today 16th of June 2020.

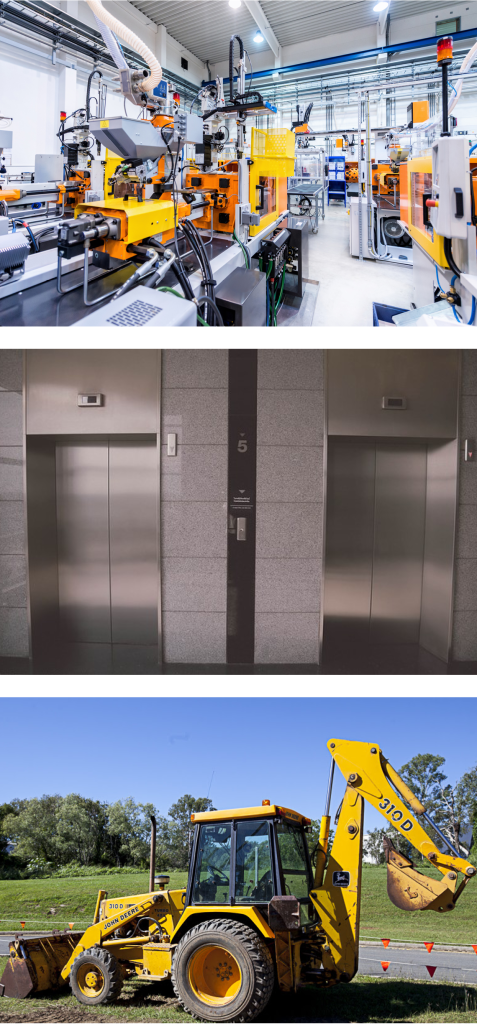

At the time of writing this, it is still unclear what the intent of the changes will mean for property owners and acquired depreciating assets as part of a property transaction. The ATO suggests that eligible businesses will be able to use the instant asset write-off provisions for the business portion of the cost of an assets in the year the asset is first used, or installed ready for use.

What does first use mean?

Date of original commissioned plant?

Does this mean that a “second-hand asset” that is currently in place and has been previously been “put in use” at the time of purchase by an eligible entity will not qualify?

Or is it a question of first use by the acquirer of the asset? Continue reading