Federal Budget extension to depreciating assets

Federal Budget extension to depreciating assets

The Treasurer delivered the Federal Budget on Tuesday 11 May 2021.

The Treasurer delivered the Federal Budget on Tuesday 11 May 2021.

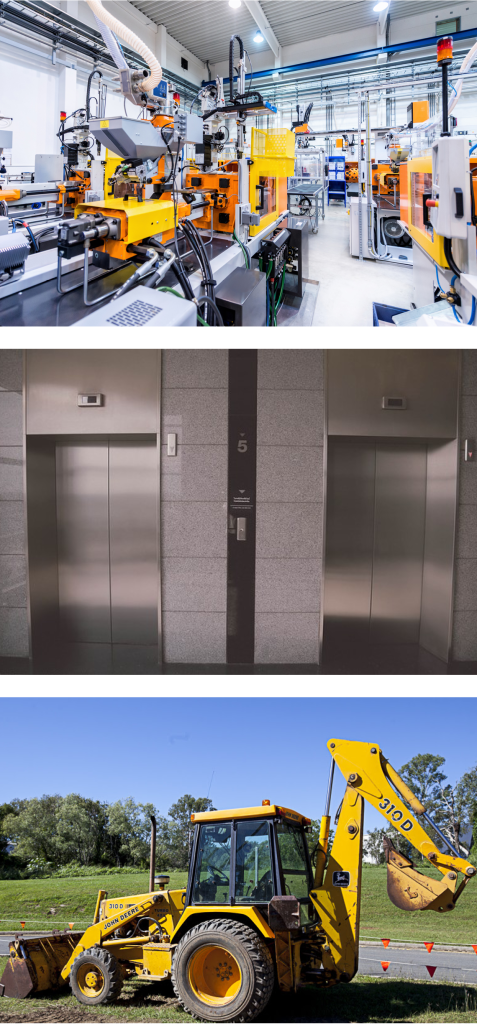

Temporary full expensing of depreciating assets will be extended for an additional 12 months until 30 June 2023, allowing businesses to deduct the full cost of eligible depreciable assets acquired from 6 October 2020 and first used or installed ready for use by 30 June 2023.

- Owners should be preparing detailed listing of depreciating assets as part of the tender process thus capturing more detail and potentially more write offs at the time of completion. A detailed analysis of variations that may have happened should pick up the rest of the write offs at completion of the project.

- There is opportunity to bring “forward” capital projects for refurbishments and upgrades.

- Any projects that are on the drawing board at this time (for investment not trading stock) and potentially due for completion by June 23 should capture the potential write off amounts for their feasibility calculations. The cash flow benefit will significantly increase as a result of the write offs. Continue reading

Economic Stimulus Packages Aids Asset Write Offs

Economic Stimulus Packages Aids Asset Write Offs

Following the Federal Government’s announcement of a raft of stimulus initiatives, N&B Director John Mathew has summarised how businesses can benefit from an immediate write off of their depreciating assets.

Following the Federal Government’s announcement of a raft of stimulus initiatives, N&B Director John Mathew has summarised how businesses can benefit from an immediate write off of their depreciating assets.

The ruling applies to assets costing $150,000 or less for eligible business, these being a business with an aggregated turnover of less than $500 million effective from 12 March 2020. The interesting part is that the date range for when assets are first used or installed ready for use is 12 March through to 30 June 2020.

Over a career preparing depreciation schedules, John commonly sees tax registers typically capitalising on all work carried out for a year, and then depreciation is calculated from the following year.

The other extreme is that monthly progress payments for multiple separate projects are capitalised and depreciated on a monthly basis although tax law requires a “project to be completed” (ready for use) before a depreciation charge can be taken. Continue reading