Have your say on the review of Effective Life of Assets

Have your say on the review of Effective Life of Assets

In the latest round of reviews for the Effective Life of Assets, the Australian Taxation Office (ATO) is examining the equipment used in several industries to determine how long these items can be depreciated. Paul Mazoletti, National Director, Commercial Tax division said “the proposed changes could see the life of some items reduced or extended, with possible new items added or others deleted from the list. Consequently, it’s imperative property investors and business operators have a current inventory list and know the effective life of their assets to maximise depreciation.”

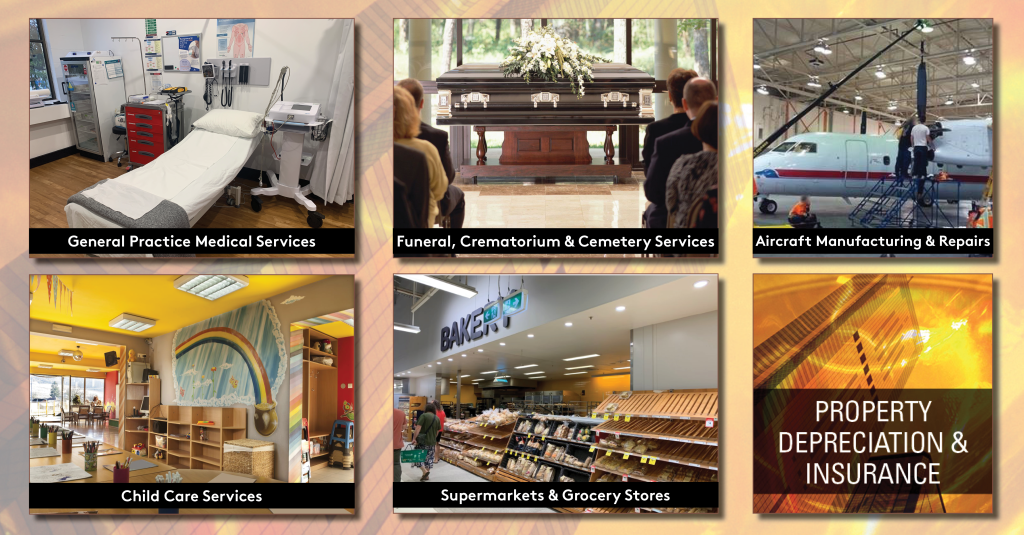

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading

Industries impacted by the review include childcare services, aircraft manufacturing and repairs, general practice medical services, funeral, crematorium and cemetery services, supermarkets and grocery stores. Industry members are invited to have their say to the proposed changes. See the full list of items under review. Continue reading

Tax time is here! Are you paying too much tax ?

Tax time is here! Are you paying too much tax ?

Do you own or have you bought an investment property in the past financial year?

Or… have you recently refurbished, altered or extended your investment property in the past financial year?

Or… do you own an investment property but have never claimed depreciation in the past?

Or… own any property including commercial, retail, industrial, residential, pubs, clubs, sporting – we are experts in them all.

If your answer is yes to any of these questions then you may very well be paying too much tax on your income if you don’t claim your depreciation deductions.

Property tax allowances (commonly known as depreciation) provide an opportunity for owners of income producing property to reduce their taxable income, thus reducing the tax payable. Continue reading